do dogs have health insurance: practical answers and money-saving tips

Short answer: yes. Dogs can be insured through pet policies that reimburse you for eligible veterinary costs. It's not identical to human health coverage, but the idea is the same - financial support when care gets expensive.

From the clinic side, I've watched owners go from shock to relief after an estimate. A plan won't stop emergencies, but it can soften the blow and help you say "yes" to treatment faster.

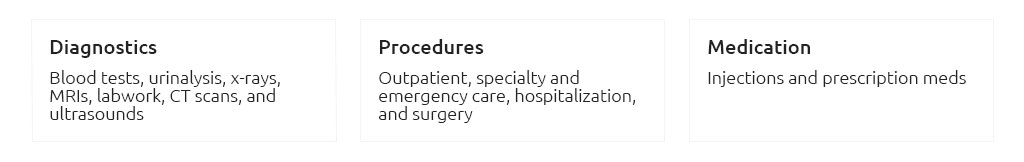

What these policies usually cover

Think of accident-and-illness plans as the backbone. Wellness add-ons exist, but the savings often appear during the unpredictable moments.

- Accidents: cuts, broken bones, foreign-body surgery.

- Illnesses: infections, GI upsets, allergies, diabetes.

- Diagnostics: X-rays, ultrasounds, bloodwork, cytology.

- Surgery and hospitalization: anesthesia, monitoring, post-op meds.

- Chronic conditions: arthritis, hypothyroidism - often covered if not pre-existing.

- Cancer care: imaging, chemo, sometimes radiation.

- Hereditary/orthopedic issues: many plans cover them after waiting periods.

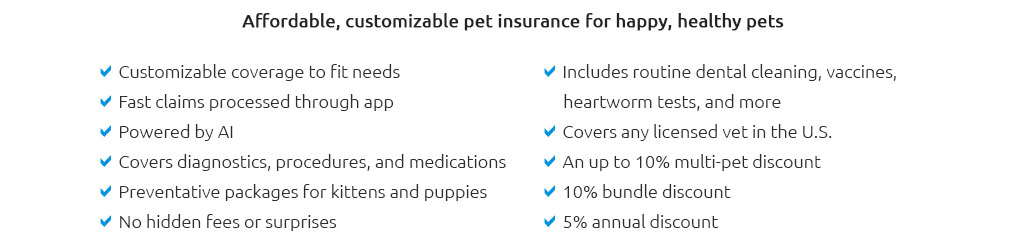

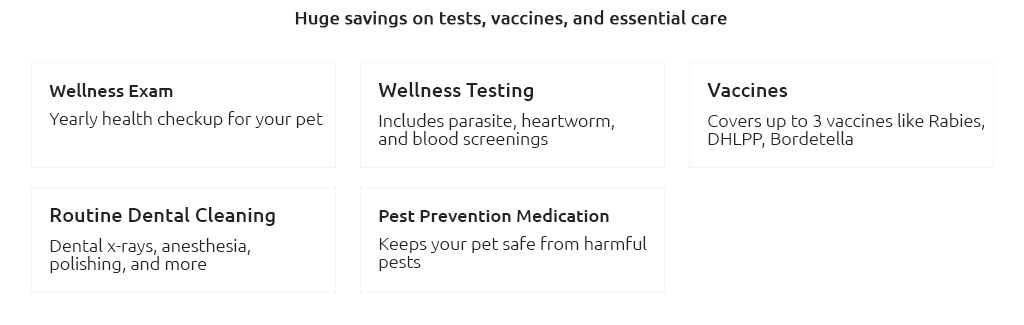

Small correction: I made wellness sound standard earlier. It isn't. Routine vaccines, spay/neuter, and dental cleanings are typically separate add-ons, and some people skip them because the math doesn't always pencil out.

Key terms that affect your bill

- Premium: what you pay monthly or annually to keep coverage active.

- Deductible: the amount you pay before reimbursement starts (per year or per condition - check which).

- Reimbursement rate: commonly 70 - 90% of eligible costs after the deductible.

- Annual limit: the maximum the plan pays each year; higher limits cost more.

- Waiting periods: coverage doesn't start instantly; accidents may be fast, knees and hips slower.

- Pre-existing conditions: usually excluded; early enrollment helps avoid gaps.

Ways to save without cutting care

- Pick a deductible you can actually cover from savings; higher deductibles lower premiums.

- Choose 70 - 80% reimbursement for a better price if you're comfortable with some out-of-pocket.

- Aim for an annual limit that fits local prices; avoid tight per-incident caps.

- Enroll while your dog is young and healthy to reduce exclusions later.

- Ask about multi-pet discounts and paying annually to skip monthly fees.

- Keep a small emergency fund to handle the deductible and copay smoothly.

- Submit clean, itemized invoices quickly; slower claims can delay cash back.

One Saturday at an agility field, a dog slid on gravel and sliced a paw. The ER bill hit $1,900. With an $250 deductible and 80% reimbursement, the claim returned about $1,320. The owner still paid some, but the budget shock was manageable.

Do you always need it?

Not always. If you maintain a robust, dedicated emergency fund and your dog is low-risk, you might self-insure. If cash flow is tight or your dog is adventurous - or your area's prices are high - insurance becomes very relevant.

- High-cost region: urban ER fees escalate fast.

- Breed risks: large breeds, brachycephalics, or orthopedic-prone lines.

- Lifestyle: off-leash trails, daycare, dog sports.

- Peace of mind: support when you need fast decisions.

How to compare plans smartly

- Run quotes for your dog's age and two nearby ZIP codes; pricing can shift by region.

- Read exclusions: dental disease vs injury, prescription food, behavioral care, rehab.

- Check bilateral clause language for knees/hips and chronic condition coverage over time.

- Confirm exam-fee inclusion and any direct-pay options to the clinic.

- Look at claim turnaround times; quick reimbursements matter.

Your veterinary team can't pick brands for you, but they see which claims get approved and can help you document visits so reimbursements go smoothly. That's practical support.

The bottom line

Yes - dogs can have health insurance, and it's most powerful as a cushion against big, sudden costs. Price it out, consider your savings, and choose a structure that keeps routine care affordable while guarding against the rare, expensive days. That balance is where insurance earns its keep - and where you save the most without compromising care.